Content

Adds markers to the classic line charts to represent essential data points. A chart, composed of multiple price bars, each visualizing the price movement of an asset or security over a specified time period. PhillipCapital Group of Companies, including PCM, their https://www.xcritical.com/ affiliates and/or their officers, directors and/or employees may own or have positions in the Products. Any member of the PhillipCapital Group of Companies may have acted upon or used the information, analyses and opinions herein before they have been published. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

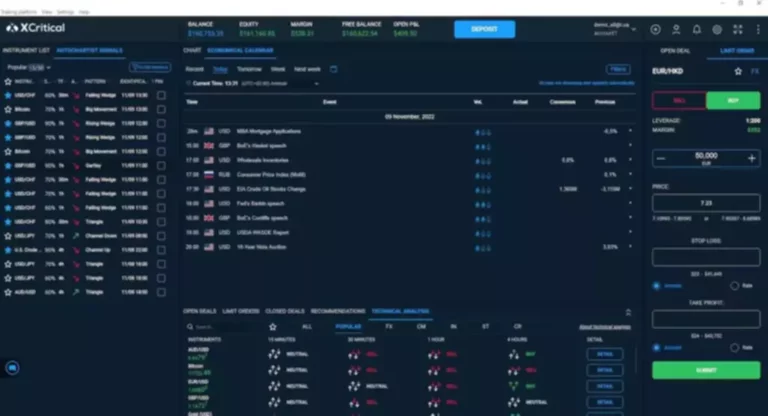

Trading platforms tested, data findings

- Finteria provides traders with a range of educational resources to help them improve their trading skills.

- Interactive Brokers offers $0 commission trades on U.S. listed stocks and ETFs to U.S. traders, like almost all rivals.

- Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers.com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures.

- Our website is focused on major segments in financial markets – stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators.

- Renowned for its advanced trading technology and competitive pricing, Interactive Brokers caters to active traders and investors seeking a broad spectrum of investment opportunities.

- An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”).

Founded in 2013, Tradingpedia aims at providing its readers accurate and actual financial news coverage. Our website is focused on major segments in financial markets – stocks, currencies and commodities, and interactive in-depth explanation of key economic events and indicators. A paper trading account is a mock investment account that allows users to pick investments without risking any real money. The account tracks the overall market and lets users see how their investments would have performed had they actually invested. If you’re an experienced investor and you want to actively trade the markets, you might consider opening a margin account instead of a cash account. trading platform features Margin accounts let you invest more than you actually deposit into your account by using leverage, or borrowed money.

Level 1 vs. Level 2 Market Data

Customizable features, such as layouts, watchlists, and alerts, allow traders to personalize the platform to suit their trading style, which can improve efficiency and decision-making. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the Decentralized finance online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level.

What’s the best trading platform for beginner or new investors?

A critical feature of any trading platform is the range of markets it offers access to. Different platforms cater to various asset classes, so understanding your own trading style and asset preferences is key. Traders can access the platform from anywhere in the world, as long as they have an internet connection.

Here’s a closer look at the must-have features that can elevate your trading experience. This guide explores the top five features to look for in the best trading platform to make sure you’re equipped with the tools and insights needed to trade confidently. These features range from ease of use to technical analysis tools and reliable security. Let’s begin by understanding what these features are and why they matter so much.

Why It MattersA user-friendly platform allows you to focus on trading rather than figuring out how to use the software. Data Feeds are crucial for price interpretation and tracking order placements and fills. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Brokers continue to roll out or enhance beginner-friendly features such as fractional shares, practice accounts (also called paper trading or simulated trading), and basic investor education. The market for online trading platforms was estimated to be worth $10.03 billion in 2024. Given these considerations, let’s look closely at the top features to consider when evaluating the best online trading platforms. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

Interactive Brokers offers $0 commission trades on U.S. listed stocks and ETFs to U.S. traders, like almost all rivals. Interactive Brokers’ charges are competitive across the board, and one area where it continues to stand out is in margin interest rates, where the firm undercuts key rivals by more than a few percentage points each. This guide will explore the most important aspects of trading platforms, helping you understand what to look for and how to evaluate your options. By the end of this article, you will have a clearer understanding of the functionality and features that can support your trading goals. Take your time to explore different platforms, test their features, and choose one that fits your trading style and goals.

This helpful learning tool is popular with beginners and is a great way to practice stock trading without risking real money. A trading platform is a software system offered to investors and traders by financial institutions, such as brokerages and banks. They essentially enable investors and traders to place trades and monitor their accounts. Before diving into the features, let’s clarify why selecting the best online trading platform is so critical. Different platforms are designed to cater to different types of investors.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice. Investments are subject to investment risks including the possible loss of the principal amount invested.

While those options make it possible to buy stocks online without a broker, on their own they are not effective ways to build a diversified portfolio of investments that is right for long-term investing. Generally, you need much less to open an online brokerage account than to open a brokerage account with a traditional, full-service broker. Robinhood, Webull, Merrill Edge and Fidelity Investments, just to name four online brokers, do not require you to deposit any particular amount of money to open an account. The user experience of the Tastytrade platform is superb on desktop and mobile devices.

However, if you’re investing money that you plan to use before retirement age, then you might opt for a taxable brokerage account. These accounts can still be used to invest for retirement as well as goals you’d like to reach before then. Categories were weighted by their relative importance for the best online broker overall, best for beginners and best for active traders. Tastytrade offers competitive pricing and fees, including commissions on equity option trades that are capped at $10 per leg.

So that’s why finding a broker with a top trading platform can be so important. An intuitive design allows traders—new and experienced alike—to focus on strategy and market analysis instead of struggling with complex navigation. Some platforms even offer customizable dashboards that let users organize tools and assets according to their needs, making trading smoother and more efficient. For anyone new to trading, a demo account can be helpful for testing the platform’s interface and getting comfortable before committing funds.

This chart visualizes trading volume, allowing traders to assess the volume of trades using candlesticks. Calculates volume data within a specified session or sub-session, allowing traders to analyze intraday volume activity for a particular segment of the session. In a market where scams and cyber attacks can be a real concern, only trading with a regulated, secure platform helps protect your assets and ensures that the platform is trustworthy.

Speed is a cumulative effect generated from efficient and seamless functionality. High caliber trading platforms are built and designed with the trader in mind. Intuitive, frictionless flow from the easy layout positioning of data windows, programmable hot keys, and robust low latency data including quotes, charts, news, and signal generation. Your trading platform serves as both weapon and armor when engaged on the battlefield known as the stock market.