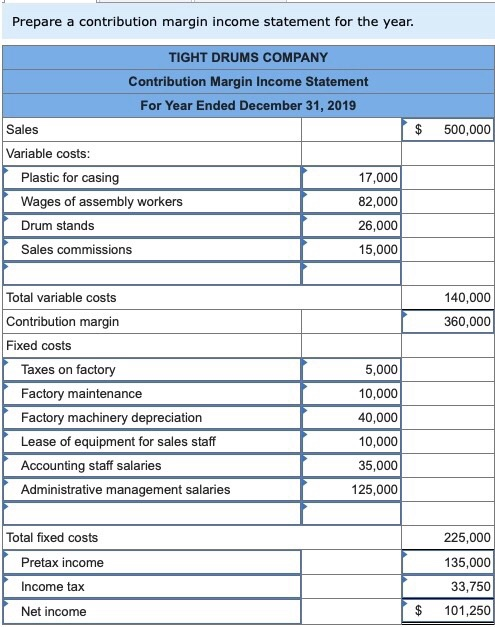

The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales. As shown in the formula above, the formula for EBIT involves taking company sales revenue, and expenses, without breaking this down into individual products or services. Contribution margin income statements are useful barometers for businesses on whether clear skies are ahead or if they need to hunker down for a storm. It’s also a cornerstone of contribution margin analysis, giving enormous insight into a business’s overall financial position.

Clear Impact of Structural Changes

It’s a critical number because it tells you if the company’s actually making money or if it’s losing money. Net profit margin is a key part of bookkeeping and helps everyone from the manager to investors understand how well the company is doing. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant. A contribution margin income statement, on the other hand, is a purely management oriented format of presenting revenues and expenses that helps in various revenues and expense related decision making processes.

Contribution Margin Ratio Calculation Example

Unlike traditional income statements that combine fixed and variable expenses, the contribution margin income statement differentiates between the two. This unique attribute enables a clearer view of how changes in production or sales levels directly affect profitability. It essentially allows finance professionals to see the forest for the trees. In essence, if there are no sales, a contribution margin income statement will have a zero contribution margin, with fixed costs clustered beneath the contribution margin line item. As sales increase, the contribution margin will increase in conjunction with sales, while fixed expenses remain (approximately) the same. Fixed expenses will increase if there is a step cost situation, where a block of expenses must be incurred to meet the requirements of an increase in activity levels.

Analysis of the Contribution Margin Income Statement

You can use the contribution margin calculator using either actual units sold or the projected units to be sold. The following are the steps to calculate the contribution margin for your business. And to understand each of the steps, let’s consider the above-mentioned Dobson example. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve.

Contribution Margin Ratios and Their Significance

Also important in CVP analysis are the computations of contribution margin per unit and contribution margin ratio. Managers consider both the contribution margin dollar amount and the ratio in making decisions related to selling price and projecting quantities sold. A higher contribution margin ratio alone is favorable relative to a lower one; the 46.9% for Projection 1 is greater than the 44.0% how to calculate depreciation rate % from depreciation amount for Projection 6. Yet if fixed costs are $375,000, the contribution margin dollar amount for Projection 1 would only be enough to break even, whereas Projection 6 would yield operating income of $26,500. Many decisions require a combination of analyses to determine the optimal outcome,but the results from separate measures can be insightful in determining points of strength and weakness.

Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa. This means the higher the contribution, the more is the increase in profit or reduction of loss. In other words, your contribution margin increases with the sale of each of your products. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000.

For example, sales may increase so much that an additional production facility must be opened, which will call for the incurrence of additional fixed costs. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently. A key element of the variable costing income statement is contribution margin, which is what is left over from sales after paying variable costs.

- It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs.

- Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold.

- Contribution margin may be looked at from a variety of perspectives that often involve comparisons within different segments of a company.

- The variable marketing and administrative expenses are then subtracted from gross contribution margin to obtain contribution margin.

Contribution Margin refers to the amount of money remaining to cover the fixed cost of your business. That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. If your total fixed production expenses were $300,000, you’d end up with ($50,000) in net profit ($250,000-$300,000). This is a loss, so you’d have to figure out how to compensate for the -$50,000 by increasing sales or decreasing fixed costs.

In all these measures, the goal is to use them as tools for making smart decisions. They’re all about figuring out not just how much money a company makes, but how it makes that money and what it means for the future. They’re essential for understanding the health and performance of a business, guiding decision making, and planning for growth. Advanced business intelligence tools are pivotal in this integration process.

If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process. At the same sales levels, the East has higher variable costs for both production and selling. Management may look at the mix of products sold in each region to determine if differences in costs in the regions are product related or if action needs to be taken to contain costs in the East.