You can connect with a licensed CPA or EA who can file your business tax returns. Finding an accountant to manage your bookkeeping and file taxes is a big decision. Set your business up for success with our free small business tax calculator. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform. We’ve tailored this guide for finance professionals hoping to deepen their understanding of this tool and leverage its benefits for more informed decision-making. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000.

Contribution margin Formula and analysis

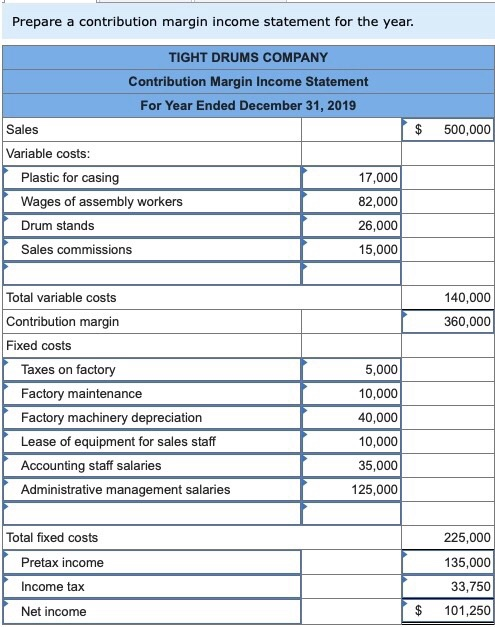

In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount.

Contribution Margin: What It Is, How to Calculate It, and Why You Need It

Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production. Instead, management needs to keep a certain minimum staffing in the production area, which does not vary for lower production volumes. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior.

Analysis of the Contribution Margin Income Statement

One of the primary benefits of contribution margin analysis is its ability to illuminate the profitability of individual products or services. By calculating the contribution margin for each offering, businesses can identify their high-margin winners and low-margin losers. This insight empowers strategic decision-making, allowing companies to allocate resources wisely and focus efforts where they’ll yield the most significant returns. Last month, Alta Production, Inc., sold its product for $2,500 per unit. Fixed production costs were $3,000, and variable production costs amounted to $1,400 per unit.

Calculating Contribution Margin with Variable Expenses

Looking at the variable expenses, each skincare product needs ingredients to be formulated, some nice packaging, and a good salesperson on commission. Let’s say that our beauty conglomerate sells 1,000 units of its bestselling skincare products for $50 each, totaling $50,000 in revenue. A high contribution margin cushions the fall from unexpected costs and dips in sales.

Contribution Margin Ratio

Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity. The concept of this equation relies on the difference between fixed and variable what is cost of goods sold and how to calculate it cogs formula costs. Fixed costs are production costs that remain the same as production efforts increase. The « contribution income statement » is a special recipe to see how sweet your lemonade sales are.

In other words, contribution margin is the amount or percentage of sales available to pay fixed costs and contribute to operating income. Once fixed costs are covered, any remaining contribution margin represents profit that results from the sales. As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula. The contribution margin income statement is how you report each product’s contribution margin—a key part of smart operating expense planning. It separates fixed and variable costs to show which products or services contribute most to generating profit.

The content on this website is provided “as is;” no representations are made that the content is error-free. Implement our API within your platform to provide your clients with accounting services. Save more by mixing and matching the bookkeeping, tax, and consultation services you need. You might have been thinking that the contribution margin sounds like EBIT or EBITDA, but they’re actually pretty different. Going back to that beauty company example from earlier, we’ll assume the business has expanded into the high-end skincare market and wants to see how the new line is performing financially. More than 488 units results in a profit, and 486 units or less result in a loss.

The following is an example of a variable costing income statement for a hotel. The room rate is $120 per night, and 700 room nights are recorded during the month. The rate per unit for each variable cost is shown in the income statement.

That’s why any business worth its salt will look to improve its margins wherever possible. To calculate how much to increase sales divide the loss by the contribution margin. Before you begin your calculations, you’ll need to understand fixed and variable expenses. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue.

- These can include things like materials for products or costs for making the item.

- Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues.

- As a result, a high contribution margin would help you in covering the fixed costs of your business.

- That is it does not include any deductions like sales return and allowances.

Another income statement format, called the contribution margin income statement11 shows the fixed and variable components of cost information. Note that operating profit is the same in both statements, but the organization of data differs. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. The contribution margin12 represents sales revenue left over after deducting variable costs from sales. It is the amount remaining that will contribute to covering fixed costs and to operating profit (hence, the name contribution margin). After we know the variable expenses, we can calculate the contribution margin ratio.