The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. In May, 750 of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May.

6: Contribution Margin Analysis

The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. The contribution margin and the variable cost can be expressed in the revenue percentage. These are called the contribution margin ratio and variable cost ratio, respectively.

( .The difference of format:

That’s because a contribution margin statement is generally done separately from the overall company income statement. To calculate the contribution margin, you need more detailed financial data to calculate EBIT. EBIT features in a company income statement as it gives the operating figures of a business more 10 steps to turn your passion into a business context. Getting this calculation right can be time-consuming and relies on consistent reporting for fixed and variable earnings. A lot of companies use financial statement software to remove the headache. The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better.

Variable costs

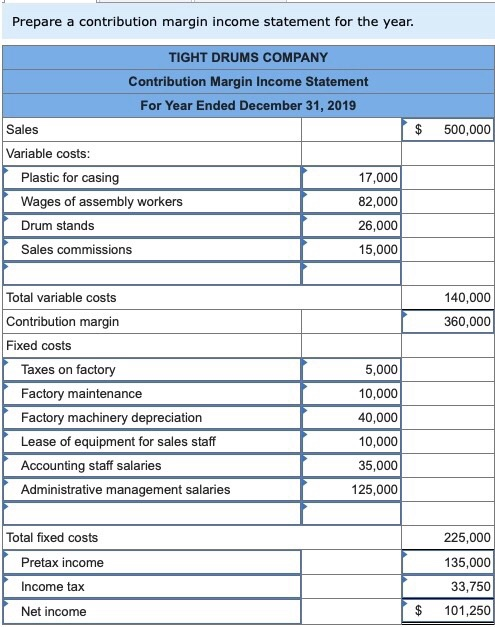

The contribution margin income statement is a useful tool when analyzing the results of a previous period. This statement tells you whether your efforts for the period have been profitable or not. The resulting value is sometimes referred to as operating income or net income. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point.

Contribution Margin: What It Is, How to Calculate It, and Why You Need It

Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. The contribution margin is different from the gross profit margin, the difference between sales revenue and the cost of goods sold. While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. A contribution margin income statement varies from a normal income statement in three ways.

The Difference Between Contribution Margin and Gross Margin

Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. The concept of contribution margin is fundamental in CVP analysis and other management accounting topics. Contribution margin refers to sales revenue minus total variable costs. It is the amount available to cover fixed costs to be able to generate profits.

Quickly surface insights, drive strategic decisions, and help the business stay on track. Parties concerned with the financial aspects of the business may be more likely to understand break-even in dollars; someone interested in operations may be more concerned with break-even in units. When you calculate your contribution margin and break-even point, be sure to use units or value consistently unless you are comfortable converting them back and forth. Depending on who is viewing your information, you may need to decide if you want to use both methods. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit.

This is because it indicates the rate of profitability of your business. Now you know all about the contribution margin income statement, how it differs from the traditional income statement, and how to make one. However, knowledge isn’t quite enough if you’ve got reports to create and stakeholders to reassure on top of your day-to-day tasks. This gives a much more detailed financial picture of the business’s operating costs and how well the products perform.

- A low margin typically means that the company, product line, or department isn’t that profitable.

- Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company.

- Net profit is making more than you spent in the period, and net loss is spending more than you made.

- Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs.

- These could include energy, wages (for labor related to production) or any other cost that raise or lower with the output levels of your business.

Depending on the type of business, either EBIT or EBITDA can be a better measure of the company’s profitability. It’s important to note this is a very simplified look at a contribution margin income statement format. Variable costs are not consistent and are directly related to the product’s manufacture or sales. They tend to increase as a company scales products and decrease with production. Some other examples of fixed costs are equipment and machinery, salaries that aren’t directly related to the product’s manufacturing, and fixed administrative costs. To work out the contribution margin, you need to understand the difference between an item’s fixed and variable expenses.

Not only does it offer immediate insights into the profitability of individual products or services, but it also aids in assessing operational efficiency. The contribution margin can highlight how changes in the structure of sales and expenses can impact the bottom line without being obscured by fixed costs. Thus, the level of production along with the contribution margin are essential factors in developing your business. Now, it is essential to divide the cost of manufacturing your products between fixed and variable costs. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

Fixed costs are expenses that don’t change, like rent, while variable costs go up or down based on how much a company makes or sells, like materials. The contribution margin income statement is a superior form of presentation, because the contribution margin clearly shows the amount available to cover fixed costs and generate a profit (or loss). It is useful to create an income statement in the contribution margin format when you want to determine that proportion of expenses that truly varies directly with revenues. At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit. The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit. Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin.