Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement.

Calculate Contribution Margin: Your Complete Guide to Gross Profit and Margin Analysis in Income Statements

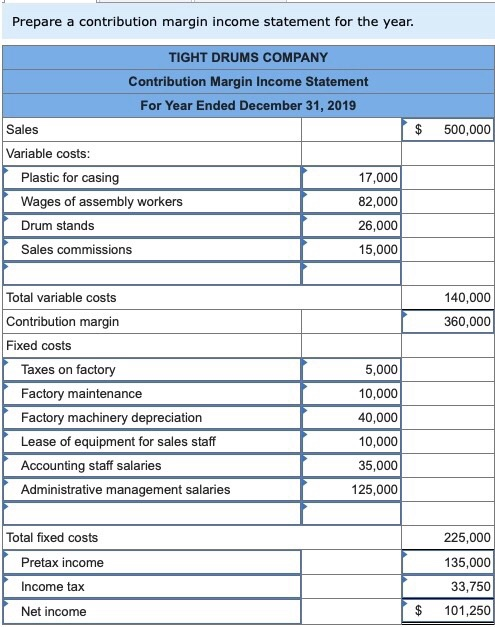

It serves as a specialized document in financial analysis that strips down revenue into critical components and provides an at-a-glance view of a company’s variable and fixed costs relative to its sales. This demonstrates that, for every Cardinal model they sell, they will have $60 to contribute toward covering fixed costs and, how to calculate fixed cost if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit. In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage).

Variable Costs in Relation to Contribution Margin

This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. The actual contribution margin is $16,000 higher compared to what was projected, partially due to more unit sales than anticipated. Although sales revenue is higher than expected, it would be worth looking into why selling price per unit was lower than projected. It is feasible that the price concession spurred the higher sales quantity. Variable costs include things like materials and sales commissions that a business spends money on every time it sells a product.

Contribution Margin Formula Components

You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. The contribution margin income statement shown in panel B of Figure 5.7 clearly indicates which costs are variable and which are fixed. Recall that the variable cost per unit remains constant, and variable costs in total change in proportion to changes in activity.

- Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

- In short, understanding variable costs and how they relate to the contribution margin is key for any business.

- The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue.

- Imagine you have a lemonade stand; the more lemonade you sell, the more sugar and cups you need.

- The contribution margin income statement shown in panel B of Figure 5.7 clearly indicates which costs are variable and which are fixed.

Armed with contribution margin insights, businesses are empowered to make strategic decisions that drive sustainable business growth. Whether it’s introducing new products, entering new markets, or optimizing existing processes, the ability to assess potential outcomes through the contribution margin lens enhances decision-making accuracy. Businesses chart a course for long-term success upon aligning actions with profitability goals. This means Dobson books company would either have to reduce its fixed expenses by $30,000. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) measures a company’s financial health. EBITDA focuses on operating expenses and removes the effects of financing, accounting, and tax decisions.

Understanding the Basics: Definitions and Formulas

However, the contribution margin for selling 2000 packets of whole wheat bread would be as follows. Remember, that the contribution margin remains unchanged on a per-unit basis. Whereas, your net profit may change with the change in the level of output. Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows.

An income statement would have a much more detailed breakdown of the variable and fixed expenses. COGS only considers direct materials and labor that go into the finished product, whereas contribution margin also considers indirect costs. For instance, Nike has hundreds of different shoe designs, all with different contribution margins. Putting these into a traditional income statement illustrates the bigger picture of which lines are doing better than others, or if any shoes need to be discontinued. Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

First, fixed production costs are aggregated lower in the income statement, after the contribution margin. Second, variable selling and administrative expenses are grouped with variable production costs, so that they are part of the calculation of the contribution margin. And finally, the gross margin is replaced in the statement by the contribution margin. Contribution margin (CM) is equal to sales minus total variable costs.

Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected.

For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or 50%. Where C is the contribution margin, R is the total revenue, and V represents variable costs. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service.

Fixed costs remained unchanged; however, as more units are produced and sold, more of the per-unit sales price is available to contribute to the company’s net income. In our example, the sales revenue from one shirt is $15 and the variable cost of one shirt is $10, so the individual contribution margin is $5. This $5 contribution margin is assumed to first cover fixed costs first and then realized as profit.